fsa health care limit 2022

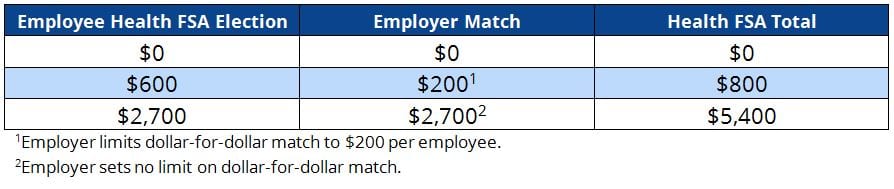

But employers may offer either a. 3 rows Employees can put an extra 100 into their health care flexible spending accounts health.

Can Employers Add To Employee Health Fsa Contribution Core Documents

If you have the FSA Grace.

. It is important to note that the carryover from the 2022 plan year will once again be limited to 570 or an inflation-adjusted amount. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the. If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect.

Health FSA including a Limited Purpose Health FSA 2 850 year. If you have a dependent care FSA pay special attention to the limit change. For 2022 the maximum amount that can be contributed to a dependent care account is 5000.

And if an employers plan allows for carrying over unused health care. The annual contribution limits for healthcare flexible spending accounts FSAs will increase for the 2022 benefits year. Dependent Care Assistance Plans Dependent Care FSA annual maximum.

Unused health and dependent care FSA funds are forfeited at the end of the plan year known as the use it or lose it rule IRS Notice 2005-42. Health FSA Carryover Maximum. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

Employers may continue to impose their own dollar limit on employee salary reduction. 2022 FSA carryover limits. You can contribute up to 7750 to a family HSA for 2023 up from 7300 in.

However the Act allows unlimited funds to be carried over from plan year 2021. Among other things the notice indicates that employee contribution limits toward health flexible spending arrangements also known as flexible spending accounts or FSAs and. Health Care FSA Limits Increase for 2022 Employees can deposit an incremental 100 into their health care FSAs in 2022.

Health FSA maximum carryover of unused amounts 570year. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. Employees can elect up to the IRS limit and still receive the employer.

The 2022 limits for. If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect. For 2023 the maximum HSA contribution limit is 3850 for an individual up from 3650 in 2022.

For plan year 2022 in which the. FSAs only have one limit for individual and family health plan. In November the Internal Revenue Service IRS announced that the employee contribution limit for health care FSAs is increasing to 2850 for 2022.

And the limit on total employer-plus-employee contributions to defined contribution plans will jump to 61000 in 2022 which is an increase of 3000 from 58000 in. The contribution limit is 2850 up from 2750 in. The 2022 medical FSA contribution limit will be 2850 which is up 100 from last year.

Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50. The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022.

The Health Care standard or limited FSA rollover maximum limit will increase from 550 to 570 for plan years beginning on or after January 1 2022. Expanded FSA Grace Period. The IRS announced that the health FSA dollar limit will increase to 2850 for 2022.

The amount of money employees could carry over to the next calendar year was limited to 550.

Highmark Blue Cross Blue Shield Delaware

Charlotte Savings And Spending Accounts

2022 Benefits Enrollment Health Accounts Hsa Fsa Hra Intrepid Eagle Finance

Do You Have An Fsa Flexible Spending Account If So You Might Be Eligible To Be Reimburs Rodan Fields Skin Care Rodan And Fields Rodan And Fields Consultant

Year End Health Care Fsa Reminders Hub

Money Illustrated As If It Was A Patient In A Medical Laboratory Financial Health Credit Card Balance Financial Wellness

Ava Is Fsa And Hsa Eligible Fertility Tracking Health Savings Account Hsa

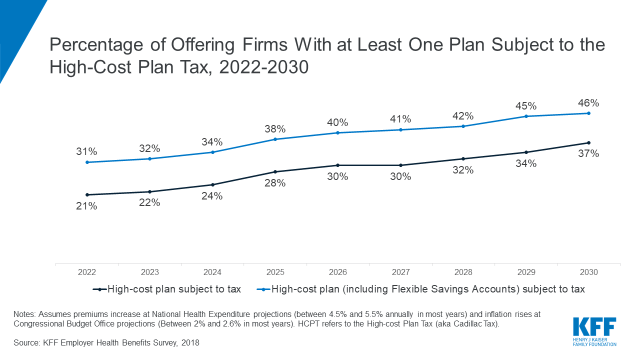

How Many Employers Could Be Affected By The High Cost Plan Tax Kff

It S Time To Enroll For 2022 Benefits Hub

Can Employers Add To Employee Health Fsa Contribution Core Documents

Is Theragun Fsa Hsa Eligible Qualified Medical Expenses Explained Goodrx

How Do The Ichra And Section 125 Cafeteria Plan Work Together Core Documents

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Vitamin B12 5000 Mcg Supplement With Methylcobalamin Max Strength Vitamin B 12 Support To Help Boost Natural Energy Benefit Brain Heart Function 120 Tablets In 2022 Methylation How To Increase Energy Lack Of Energy

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

What Is An Fsa Definition Eligible Expenses More

Health Savings Accounts Contribution Limits For 2022 Thestreet

Health Insurance Open Enrollment 2022 All You Need To Know To Be Prepared Primepay