greenville county property tax estimator

Greenville County collects on average 066 of a propertys assessed fair market value as property tax. The median property tax on a 14810000 house is 97746 in Greenville County.

Pickens Sc Homes For Sale And Real Estate In Pickens Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Williams Gr Real Estate Estates Lake Keowee

If you have general questions you can call the Town of.

. Personal property tax also applies to equipment furniture fixtures and machinery primarily used by businesses. 2500 Stonewall Street Suite 101 Greenville TX 75403. Search for Voided Property Cards.

This calculator is designed to estimate the county vehicle property tax for your vehicle. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. Contact your county tax.

You can call the Town of Greenville Tax Assessors Office for assistance at 207-695-2421. With the exception of motor vehicles personal property taxes must be paid by January 15 of the following year unless that day falls on a county holiday or weekend. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein.

All Years 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012. Only search using 1 of the boxes below. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor.

Ultimate Greenville Real Property Tax Guide for 2022. County functions supported by GIS include real estate tax assessment law enforcementcrime analysis economic development voter registration planning and land development. --Select one-- Camper - 1050 Vehicle Business - 1050 Vehicle Individual - 600 Watercraft - 1050.

The median property tax on a 14810000 house is 155505 in the United States. The calculator should not be used to determine your actual tax bill. Greenwood County Tax Estimator South Carolina SC.

903 408-4001 Chamber of Commerce Office 1114 Main St. Tax amount varies by county. The assessors office can provide you with a copy of your propertys most recent appraisal on request.

The Greenville County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Greenville County. The largest tax in. DMV Registration fees are charged every 2 years.

Find Greenville County Property Tax Info From 2021. VIN SCDOR Reference ID County File. Whether you are already a resident or just considering moving to Greenville County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

This website is a public resource of general information. Please call the assessors office in Greenville before you send documents or if you need to schedule a meeting. Greenville County South Carolina.

Granville County Public Access - Tax Bill Search. For an estimation on county taxes please visit the Greenville county or Laurens county. Estimated Range of Property Tax Fees.

Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher than the state average. The largest tax in. For a list of tax authorities that levy taxes in each district please refer to the.

Greenville County collects relatively low property taxes and is ranked in the bottom half of all counties in. When are personal property taxes due. The median property tax on a 14810000 house is 74050 in South Carolina.

Whether you are already a resident or just considering moving to Greenville to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Tax rates vary according to the authorities ie school fire sewer that levy tax within individual tax districts of Greenville County. The Greenville County Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable properties in the same neighbourhood.

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. Please make your check payable to Greenville County Tax Collector and mail to. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on.

Millage Rates vary among the 136 Tax Districts within Greenville County. Tax Collector Suite 700. Richland County - Personal Vehicle Tax Estimator.

Search Vehicle Real Estate Other Taxes. Remember to have your propertys Tax ID Number or Parcel Number available when you call. South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median.

The countys average effective rate is 069. Learn all about Greenville County real estate tax. The median property tax on a 13750000 house is 144375 in the United States.

Our mission is to provide accurate and timely geographic information system access technical assistance and related services to meet the needs of County operations. Please enter the following information to view an estimated property tax. The median property tax on a 14810000 house is 97746 in Greenville County.

This calculator is designed to estimate the county vehicle property tax for your vehicle. The Greenville County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. The median property tax on a 13750000 house is 68750 in South Carolina.

The reader should not rely on the data provided herein for any reason. To determine an estimate of tax assessed on your property please visit the Vehicle Tax Estimator or the Real Estate Estimator. Your county vehicle property tax due may be higher or lower depending on other factors.

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. Yearly median tax in Greenville County.

Pin On Beautiful Homes In New Jersey

Ultimate Guide To Understanding South Carolina Property Taxes

Congratulations To Sccja Class 650 Tri County Fop Lodge 3 Congratulations Class

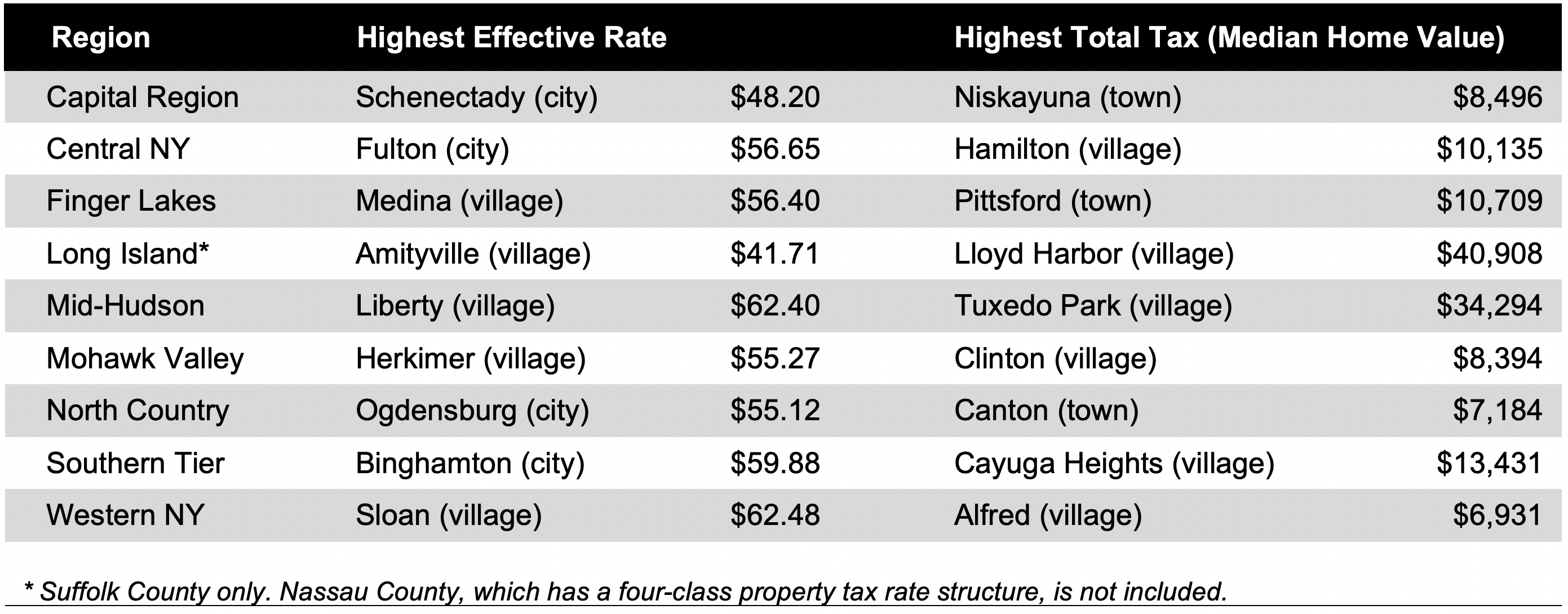

New York Property Tax Calculator 2020 Empire Center For Public Policy

South Carolina Property Tax Calculator Smartasset

South Carolina Property Tax Calculator Smartasset

Tax Rates Hunt Tax Official Site

Estate Of The Day 7 5 Million Private Majestic Home In Oak Brook Illinois Mansions Luxury Homes Bohemian Style Bedrooms

Soaring Real Estate Sales And High Prices Mean More Property Tax For Sc Towns Cities News Postandcourier Com

How Do Property Tax Rates Compare Across North Carolina

Why Land Values Are Rising In Greenville County South Carolina

South Carolina Property Tax Calculator Smartasset

Tennessee Base And Elevation Maps Map Elevation Map Tennessee

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

How Greenville County Assesses Taxes The Home Team

Elkton At High Oaks Estates Luxury New Homes In Walpole Ma Delaware Homes For Sale Dream Home Design Luxury Homes

Eplans New American House Plan Main Level Master Bedroom 3148 Square Feet And 4 Bedrooms From E American House Plans Colonial Style House Plans House Plans